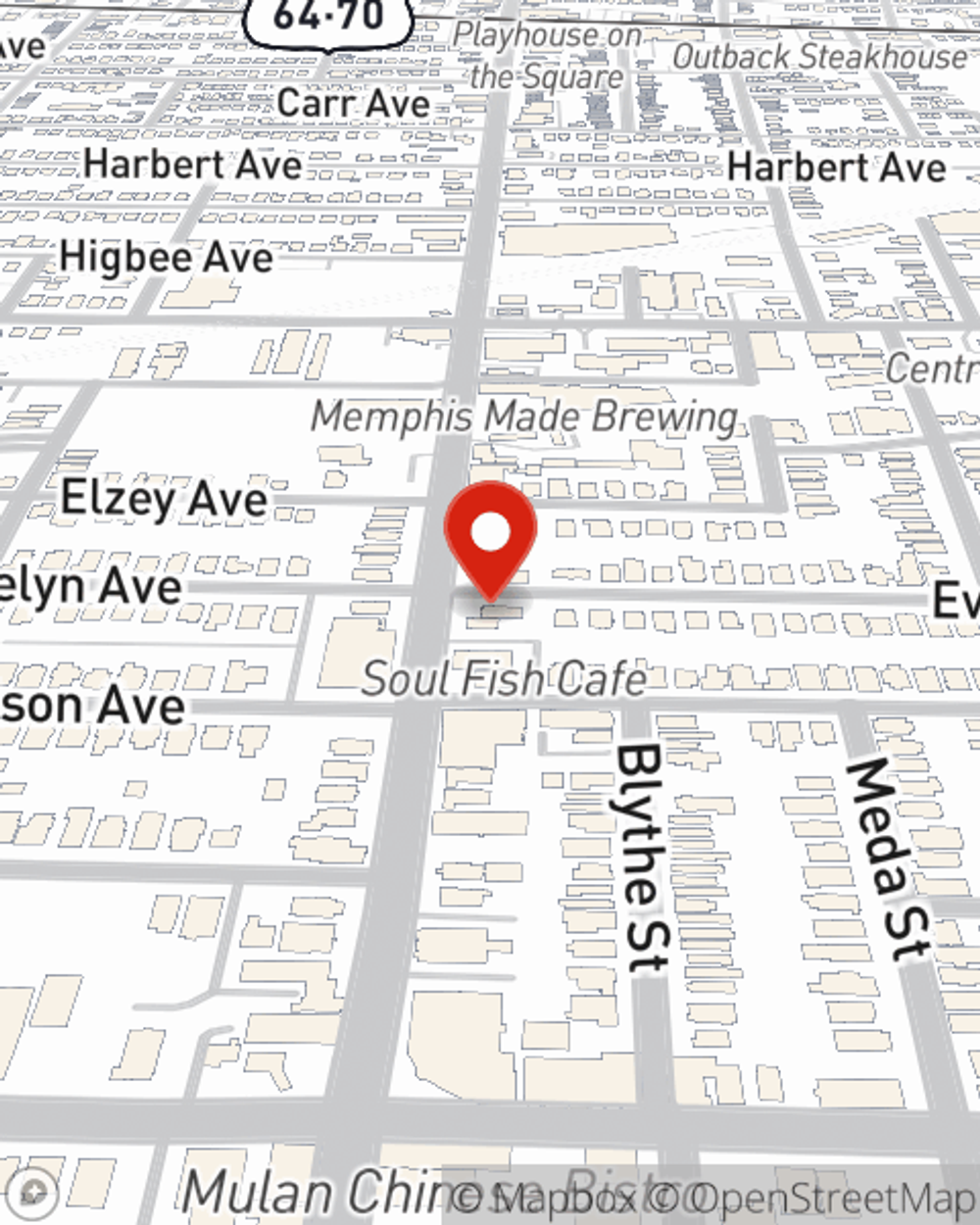

Business Insurance in and around Memphis

Get your Memphis business covered, right here!

Cover all the bases for your small business

Coverage With State Farm Can Help Your Small Business.

Though you work so hard to ensure otherwise, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer hurts themselves on your property.

Get your Memphis business covered, right here!

Cover all the bases for your small business

Keep Your Business Secure

Protecting your business from these potential accidents is as easy as choosing State Farm. With this small business insurance, agent Steve Womack can not only help you personalize a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Take the next step of preparation and call or email State Farm agent Steve Womack's team. They're happy to help you discover the options that may be right for you and your small business!

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Steve Womack

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.